Since the invasion of Ukraine, fundamental changes to tanker trade flows and fleet ownership have occurred. Using Gibson’s proprietary fixture and vessel data can help to identify changes in real time, and in some cases, before they happen.

What is fixture data? The term fixture is used to describe a chartering contract. Fixture data provides a summary of the chartering contract including information such as the performing vessel, load and discharge ports, agreed freight rates, chartering entity, cargo specification and quantity, and the load dates. Fixtures are typically reported 1-3 weeks before a vessel loads, thus giving advanced notification of a planned voyage before the vessel reaches the load port.

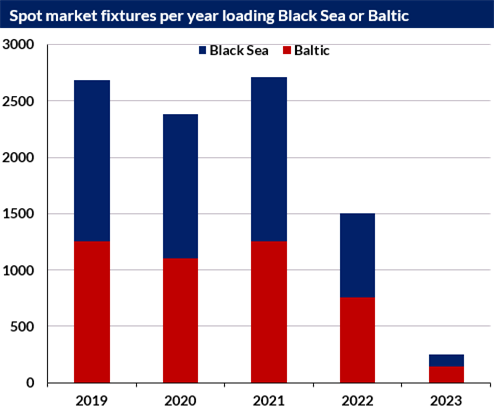

Since the invasion, increased scrutiny has emerged concerning fixtures from Russian ports, particularly in the Baltic and Black Seas. Prior to the war, tanker spot fixtures (both crude and products) ranged from 2,400-2,700 per year depending on production and demand. However, in 2022, total spot fixture volumes from these load regions declined by over 45% as increased volumes were transported on the ‘dark’ fleet, and thus absent from the spot fixture market.

In terms of the main players involved in the trade and comparing 2022 to 2019 to mitigate the covid years skewing the data, most notable is the withdrawal of major western oil majors such as Shell, BP and Total. Fixtures data confirms these companies were true to their pledges well before sanctions came into effect. Our data also confirms the emergence of many smaller (and often new) traders into shipments previously dominated by western trading houses.

Fixtures data also helps us understand which owners are shipping Russian crude and products since the relevant G7 price caps came into place. Again,

data shows much reduced volumes being carried by Western shipping companies, although not a complete departure as many expected. Furthermore, in recent weeks our data indicates more Western shipowners are gaining the confidence to return the Russian oil shipping market.

These findings are merely just a snapshot of the insights which can be gained from analysing fixtures and vessel data, be it from a trade or compliance perspective. Gibson provides its fixtures data to a range of clients in various formats including an API.

Written by Richard Matthews,

Director - Consultancy & Research

E.A Gibsons Shipbrokers Ltd

Comments